J&T Super Service, Present Premium Shipping Guarantee

J&T Super Service, Present Premium Shipping Guarantee

Delivery service company J&T Express launched a new service, namely J&T Super, an innovation of delivery convenience that arrives on the day up to less than 2 days. With a variety of extra services on this service, complement the differentiation of regular services already in J&T Express.

J&T Express CEO Robin Lo said that the demand for fast delivery is increasingly sought after by the public, especially in densely populated areas, it is necessary to create something new.

J&T develops this service by prioritizing a faster and more precise service level agreement (SLA) guarantee, so that it can meet delivery requests with the urgency of customer needs. Currently J&T Super has been available for the coverage of Jakarta, Tangerang, Bekasi, Depok and Bogor, it is expected that this service can serve the entire region of Indonesia gradually,” said Robin Lo in his release statement.

J&T Super services provides package protection guarantee or warranty at no additional cost, claim processing service within 1×24 hours, up to 100% refund of postage with terms and conditions applicable if the package does not arrive in accordance with the delivery SLA. J&T Super can currently be used through non-market place shipping transactions and can be delivered via drop off and pick up only with a maximum weight of up to 3 kg.

As of April 1, 2021

This service can be used from April 1, 2021, while the SLA of J&T Super service is delivered to the same city below 10.00 WIB then the package will arrive on the same day before 21.00 WIB. However, if the delivery destination in the same or different cities after 10.00 WIB then the package will arrive tomorrow before 12.00 WIB. With this time adjustment J&T Express provides premium service with priority delivery easy and fast arrive.

Previously at the end of last year J&T Express also added J&T ECO service that is devoted to delivery at an economical price, as well as a type of self-service package delivery J&T Jemari (Pick Up Package Mandiri) which is a convenience for customers who want to pick up packages through the drop point they want. Followed this time J&T Super comes with a new feel for premium delivery.

Entering its sixth year of existence this year, J&T Express some time ago has also launched air freighter at Budiarto Airport, Curug, Tangerang supported by air freighter operator Trigana Air. The presence of this air freighter to increase the efficiency of package delivery is increasing, especially outside java.

J&T Express launched air freighter to be able to increase the efficiency of airline delivery in line with the increasing number of packages, especially in areas outside Java,” said Robin Lo. Through this innovation, J&T Express also wants to increase service level agreement to customers.

Air freighter operator Trigana Air supports J&T Express’s move to streamline airline delivery.

“We welcome J&T Express’s breakthrough as a delivery service that seeks to accommodate air delivery to be more efficient without limited delivery schedules that are less erratic. In this case we also hope to support each other and together answer business challenges in this pandemic,” said Rudi Hartono, Technical Director of Trigana Air.

J&T Express launched an air delivery service that will use a 150-ton payload. This aircraft will deliver goods by air and intended for Sumatra.The increasing occupancy of goods delivery up to 5 million packages per day makes J&T have to innovate to deliver goods in a timely manner.

J&T Express will use Boeing 737-300 and 400 aircraft. In addition, inter-island flights will be served by ATR 42 and 72 aircraft. As a pilot project, J&T Express serves two air freighter routes, namely Jakarta-Medan and Jakarta-Batam. The aircraft is also planned to operate at least once a day.

&T Express CEO Robin Lo explained that in addition to improving services, air freighter aims also to balance the courier business with the growing e-commerce business during the pandemic

>>>Malaysia Set To Launch Drone Delivery Service

About Boxme: Boxme is the premier E-commerce fulfillment network in Southeast Asia, enabling world-wide merchants to sell online into this region without needing to establish a local presence. We deliver our services by aggregating and operating a one-stop value chain of logistic professions including: International shipping, customs clearance, warehousing, connection to local marketplaces, pick and pack, last-mile delivery, local payment collection and oversea remittance.

Halal Cosmetics Trend Gaining Traction in Southeast Asia

An emerging trend in the beauty industry across the globe in recent years is the demand for halal cosmetics. While having greater recognition in Asia, the Southeast Asian region proves to be the best market for halal cosmetics.

Growing Demand For Halal Cosmetics

Southeast Asia is considered the largest producer of halal cosmetics at around 40%. According to a 2019 report by WiseGuy, in sales the Middle East has a 12% market share, and the USA and Europe just 4%. With that, the global halal cosmetics market is estimated to be worth US$2.5 billion and growing at 5.6% a year.

The State of Global Islamic Economy Report 2018/19 reports that halal pharmaceuticals and cosmetics sectors continue to expand as more products are produced and ingredients are increasingly halal-certified. The report also states that Muslims’ spending on cosmetics was estimated to be US$61 billion in 2017, which is foreseen to increase to US$90 billion by 2023.

Realising the growing trend for halal cosmetics and its promising market, small and independent players as well as large powerhouse brands across the globe are pushing for developments to cater to the demand.

Among the brands that are pioneering into halal beauty are Amara Halal Cosmetics, Inika Organics, Talent Cosmetics, Tuesday In Love, Momohime Skincare, and Wardah Cosmetics. Not mentioned are a long list of SMEs across the world mostly originating from the Southeast Asia region, especially Malaysia and Indonesia. Several global industry players have also made the move to cater to Muslims and the growing market by setting up their own halal hub in parts of Southeast Asia.

K-Beauty Going Halal

Standing on the precipice of the growing popularity of Korean cosmetics (also known as K-beauty), South Korean has positioned itself as the sixth largest global exporter of essential oils, perfumes, cosmetics and toiletries, after France, the USA, Germany, Ireland, and Singapore. According to figures from the International Trade Centre Trade Map, South Korea’s exports grew by 25.7% to US$6.25 billion in 2018.

Exports to Organisation of Islamic Cooperation (OIC) countries surged in recent years, rising from 3.2% of Korea’s total cosmetics exports in 2017 to 3.7% in 2018, and 4.2% in 2019, to US$271 million, according to the Korean Institute of Halal Industry (KIHI).

By region, Southeast Asia leads at US$150 million, dominated by Malaysia at US$89 million, and Indonesia at US$61 million.

Certification of Korean cosmetics is on the rise, backed by the drive for cosmetic trends with natural or herbal cosmetics ingredients and product concepts. Aided by the growing number of halal certification bodies (HCSs) in the country recognised by international bodies from one to three last year, the South Korean government pushes exports to OIC countries and established joint ventures with halal cosmetics companies in Malaysia and Indonesia.

> Read more: 3 E-commerce Cosmetics Market Trends in Malaysia 2020

Malaysia As the Lead

In line with Malaysia’s Third Industrial Master plan 2006-2020, the halal industry is set to become the country’s key economic driver and a catalyst for local players to tap into the global halal market and turn them into viable ventures that are capable of catering to both Muslims and non-Muslims.

Malaysia is listed among the top 10 producers for halal pharmaceuticals and cosmetics industries in the world. According to the Halal Directory by Halal Industry Development Corporation (HDC), there are 26 companies listed under the cosmetics business industry, 124 under the beauty category and 3 under the skincare category, to date.

In Malaysia, among the top homegrown halal cosmetics and skincare brands are SimplySiti, Pretty Suci, So.Lek, Nurraysa, dUCk Cosmetics, and Elhajj Halal Skincare. Many more Malaysian SMEs specialising in halal cosmetics and skincare products are emerging and making a name for themselves in the market.

> Read more: Popular Product Categories in Malaysia of 2020

Indonesia Following Closely

With its massive population of 270 million people, Indonesia is projected to be a major driver of growth for halal cosmetics in the world following the implementation of the Halal Product Assurance Law No.13/2014 in October 2019. The law requires mandatory halal certification for all products that are considered to be halal.

Around 80% of the country’s market share of cosmetics products already have halal certification. The number is expected to increase following the footsteps of leading Indonesian halal cosmetics brand Wardah.

> Read more: E-commerce opportunities in Indonesia

Quality Products For Everyone

Halal cosmetics are not limited to Muslim practitioners. Jacques Cosmetics Malaysia says that their halal certified cosmetics are made for all beauty enthusiasts who want quality products that are free from harmful ingredients.

The Malaysian cosmetics manufacturer and retailer launched Reneuf by La Estephe as their first halal venture. Reneuf by La Estephe is a range of sheet face masks that have been certified halal by JAKIM.

The company also states that some consumers, especially non-Muslims are under the impression that halal certified products are only for Muslim. However halal cosmetics actually mean that the product is safe, clean and ethically produced, and can be used by anyone regardless of religion.

> Read more: E-commerce Fashion Industry in Malaysia 2020 – 2021

What Does Halal Mean?

Halal is an Arabic word meaning “allowed” or “permissible”. When a product is described as halal, it means that it uses ingre and storing, manufacturing, packaging and distribution processes that are in accordance with the Shariah law and fatwa.

Putting a halal certification on skincare or cosmetic products would mean that those products are free from animal-derived ingredients (such as animal fats, placenta, etc.) as well as contents which are harmful to health and have not been processed using instruments contaminated with impurities (such as blood, urine, and faeces).

Some halal certified beauty products also have vegan, organic, cruelty-free or ethical tags and certifications that are in accordance to industry standards.

In Malaysia, the halal certification will need to be acquired from and approved by the Department of Islamic Development Malaysia (JAKIM). Aside from adhering to a list of guidelines, the products will need to be inspected before obtaining the certification.

Overview

The cosmetics market in Southeast Asia is more developed as compared to other regions as there is greater awareness among consumers and a well established halal regulatory environment with specific cosmetics regulations, especially in Malaysia and Indonesia.

Muslim beauty (also known as M-beauty) is gaining more visibility and is predicted to be the next big thing after K-beauty as halal cosmetics continue to grow and gain strong traction, aided by large manufacturers having more interest in halal formulations than before.

More Reading

> E-commerce Fashion Industry in Malaysia 2020 – 2021

Annual Holiday Announcement

Dear our valued customers,

Boxme Vietnam would like to announce our schedule of activities during the Reunification Day & International Labor day as follows:

1. Vietnam

Vietnam Warehouse and Operation takes 2 days off.

- Public holiday from Friday, April 30, 2021 to Saturday, May 1, 2021.

- Warehouse: Return to work on Sunday, 2nd 2021

- Office: Work normally on Monday, May 3rd 2021

2. Thailand, Malaysia, Phillipines and Indonesia

- Warehouse and operation of Indonesia, Philippines, Thailand, and Malaysia take 1 day off on Saturday (May 1, 2021)

- Returning to work on Monday, May 3, 2021

Sincerely thank you for your trust and cooperation.

Wishing you and your family a peaceful holiday!

Best regards,

Mr DIY Launches 1st Robotic E-commerce Warehouse

Malaysia’s home improvement retailer Mr DIY has launched an e-commerce warehouse that features robots. The robotic e-commerce warehouse in Seri Kembangan, Selangor is the result of an investment of up to US$1.22 million (RM5 million) by Mr DIY Group to design and build a warehouse system that aims to boost the speed of its online order processes.

Robotic E-commerce Warehouse

The robotic e-commerce warehouse spans 65,000 square feet and is equipped with programmable robots that can fulfil online orders faster and result in a 200% increase in operational efficiency.

Mr DIY had started the design and construction of the robotic e-commerce warehouse in 2019 to adopt Fourth Industrial Revolution (IR4.0) technologies and to keep pace with the growing demand for online shopping, a trend that has been gaining traction in Malaysia in recent years.

The company’s new robotic e-commerce warehouse enables warehouse employees to process online orders at triple the previous rate from manual to automated order processing, thus allowing customers to expect their orders to be delivered faster and earlier.

The automated functions of the robots help reduce the possibility of human error, and the innovative design of the warehouse system enables the robotic e-commerce warehouse to stock a wider range of products, giving customers a broader choice of more than 20,000 products online.

> Read more: Shopee Malaysia Rolls Out Next-Day Delivery Service

Robotic Assistance

The robots will help with the transporting of products from storage to the sorting area where the warehouse employees will do the picking process and transfer the items to pack, followed by getting them ready for delivery.

To achieve this, programmed tracks are installed to guide the robots around the robotic e-commerce warehouse. Specially designed shelves are used so that the robots can drive under them before lifting them up and ferrying the shelves full of products to where the sorting area is located.

This saves the warehouse employees time that would otherwise be spent scouring around the massive robotic e-commerce warehouse for products. Furthermore, all products are meticulously labelled to reduce human error.

> Read more: Malaysia’s Ecommerce Economy Thrives During COVID-19

Humans Still Required

Mr DIY’s robotic e-commerce warehouse opens up the opportunity to upskill their warehouse employees in robotics and automation, providing more opportunities for career development and advancement.

As automation in the robotics e-commerce warehouse shifts labour force away from low-skilled jobs previously carried out by warehouse employees, Mr DIY will provide training for their existing warehouse employees to upskill them in technical roles to manage and fix the robots when they require servicing. The warehouse employees will also perform in-between tasks that the robots are unable to do.

Despite the strategy to ramp up their e-commerce operations, Mr DIY do not intend to slow down in the brick-and-mortar sector. The retailer had announced that they will be looking to open 175 new stores in 2021 across their 3 brands – Mr DIY, Mr Toy, and Mr Dollar.

More Reading

> Top 10 Best Courier Services in Malaysia 2021

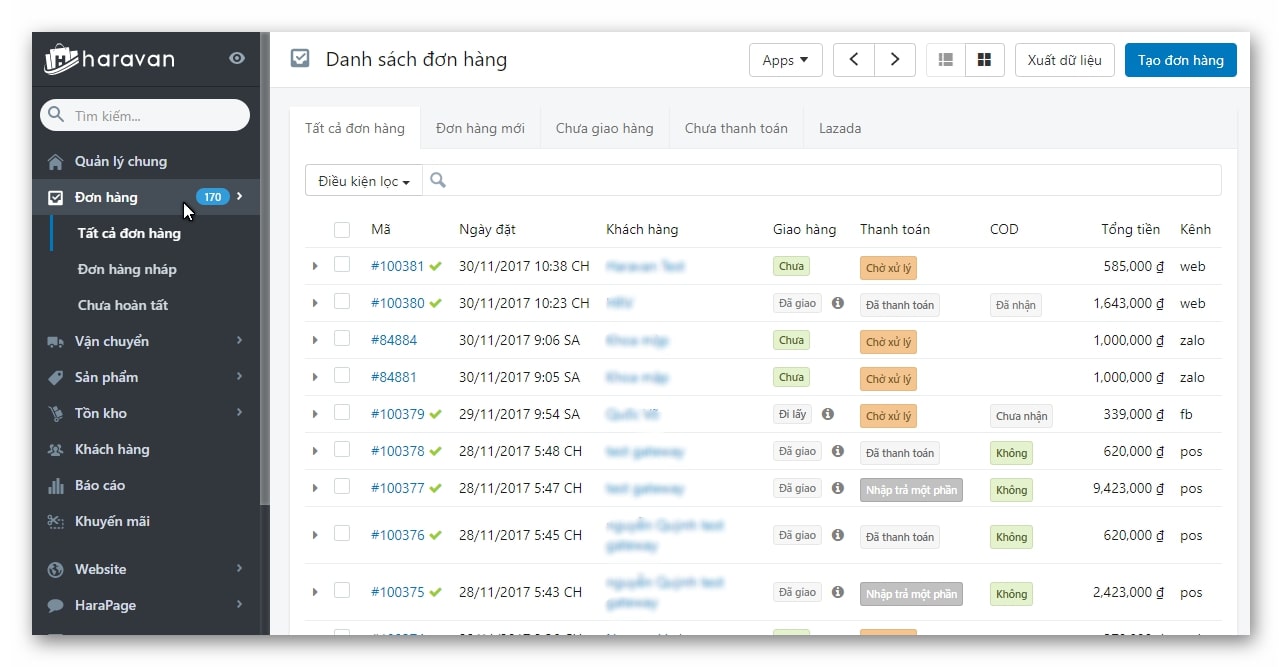

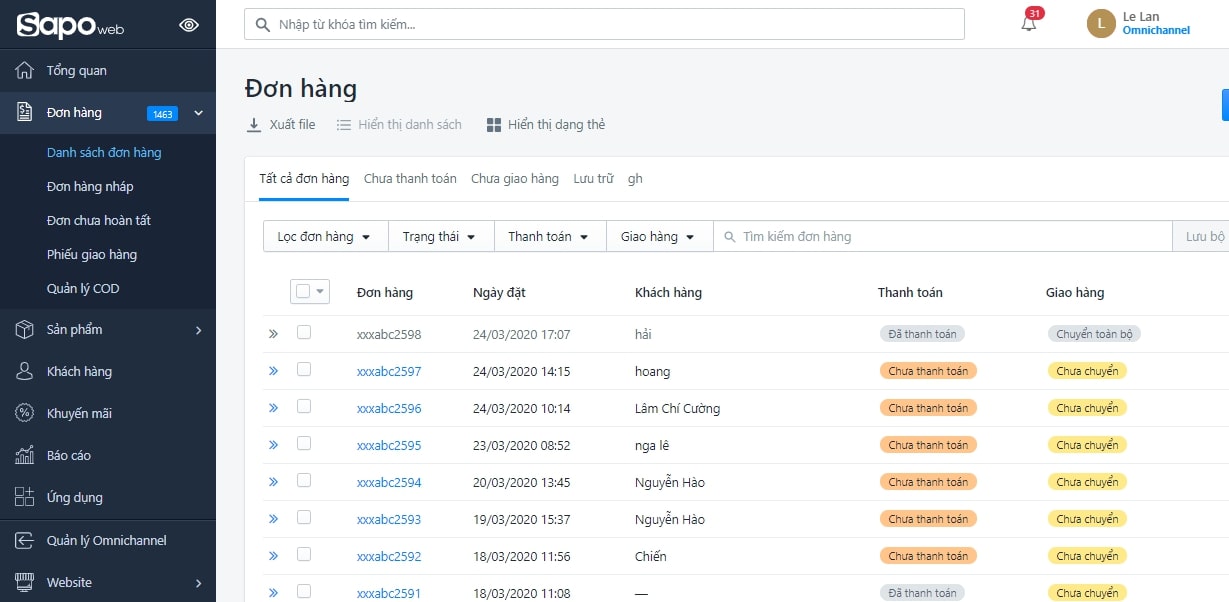

Sapo and Haravan – the battle of two leading Vietnam e-commerce development websites

Embark on building online business, creating a retailing website and multi-channel selling strategy. Business retailer starters want to deploy sales on multiple channels using omni-channel platforms but confusing whether to choose between Haravan or Sapo.

>> Read more: Multichannel vs. Omnichannel retail: The differences

>> Read more: Ways to Optimize Fulfillment for Omni-Channel E-Commerce Businesses

Boxme here to help you by identifying the difference together with pros and cons of the most popular e-commerce development websites in Vietnam

What is Omnichannel ?

Omnichannel is the integration of all physical (offline) channels (stores, chain stores) and digital channels (online) such as e-commerce platforms Tiki, Shopee, Lazada, Sendo, … or Facebook / Google sales channels for unified customer experience. According to Frost & Sullivan, omnichannel is defined as “a high-quality, seamless and easy customer experience that occurs within and between communication channels.

>> Read more: Multichannel vs. Omnichannel retail: The differences

In the simplest way, omni-channel is to build both online and offline stores that synchronize in all access channels to sell products to customers and centralize management in one place.

>> Read more: Ways to Optimize Fulfillment for Omni-Channel E-Commerce Businesses

Accordingly, we can evaluate the choice of the Omnichannel platform based on the sales channel system that the haravan or sapo system is connected to.

>> Read more: Who is the leading eCommerce platform in Vietnam?

Scale

Sapo Web is one of the products of Sapo Technology Joint Stock Company (formerly DKT company) that has been developed since 2008 to now with more than 67,000 customers using the service. Sapo is headquartered in Hanoi, offices in Ho Chi Minh, Da Nang, Hai Phong, Binh Duong, and Tay Nguyen … with several hundred employees.

Haravan, although being a late comer than Bizweb (Sapo), Haravan has been thriving in the Vietnam market with a drastic development and advancement. Haravan’s headquarters in Ho Chi Minh City and on the homepage also figures that there are more than 50,000+. Thanks to the rapid development, Haravan is gaining significant popularity in the Vietnam market as one of the leading e-commerce development websites.

>> Read more: Vietnam Ecommerce platform: Who to choose?

>> Read more: Who is the leading eCommerce platform in Vietnam?

Interface

In this area, both e-commerce development websites share the commodity in the interface. Both units have a huge number of themes, different customization features, and are compatible on all different interfaces. In terms of the interface provided by both platforms, I think they are equal because they both took and reconstructed quite a lot of samples from foreign website samples.

At the same time, both e-commerce development websites are open platforms for developers to sell their skins on.

The interface uses Responsive features to be compatible with many different devices.

If with Sapo, the partner’s interface costs more, but it feels more diverse and stable. With Haravan, the advantage of being a free interface, brings the optimal cost.

Price

In order for customers to fully experience all of the e-commerce development website’s features before making any decision, both Sapo Web and Haravan allow users to have free-trial in 15 days.

About price, both units once again share the same pattern in price with no to little difference

- Sapo Web package is priced at 229,000 VND / month + 1,500,000 original website creation fee. When customers sign up for 2 years or more, you will receive 10% off and start-up free. Thus, the cost is about 5,088,000 VND for a 1-year package and 6,458,000 VND for a 2-year subscription.

- Haravan Advanced Website package costs 500,000 VND / month. Annual payment at the price of VND 6,000,000 / year

Customer service

Both units are highly appreciated by customers for the quality of service and customer care. Each unit has a customer support portal. So if there is any problem related to poor service quality, customers can directly report them to the center for support.

> Read more: Is Your Fulfillment Process Actually Delivering on Your Customer Promises?

>> Read more: How to choose the right courier service? Here are tips you need to know

Special features

These are the listing of significant features that both e-commerce development websites are thriving on

- Security SSL: HTTPS and SSL settings for the website are completely free, customers can be absolutely assured of absolute security of HTTPS and SSL with international standards. Consequently, customer’s private information is highly protected from viruses and hackers.

- Automatically connect with local courier delivery services: Sapo and Haravan are both open platforms that allow third parties to join the system to assist customers in online transportation and payment.

- Integrate Google Analytics and Google Shopping: This feature helps website administrators have an overview of investment in advertising with sales revenue.

- Assistance on multi-channel development

>> Read more: Offline Vs Online Store: weakness & strength

Cons

- Sapo: Sapo web users have some troublesome in terms of limited usage of about 5GB, if users want to expand more usage, there will be an additional cost to buy storage.

- Haravan: Haravan has a user limit of 10, which poses certain difficulties for multi-chain stores. Additionally, Haravan does not support email marketing, reports, and statistics like Sapo Web, does not support SSL for lower packages and high multi-channel sales costs, up to 899 thousand VND for a month of use.

More readings?

>> Read more: Ways to Optimize Fulfillment for Omni-Channel E-Commerce Businesses

>> Read more: OMNI-CHANNEL RETAILING: THREE KEYS TO WIN THE GAME

>> Read more: Who is the leading eCommerce platform in Vietnam?

>> Read more:Vietnam Ecommerce platform: Who to choose?

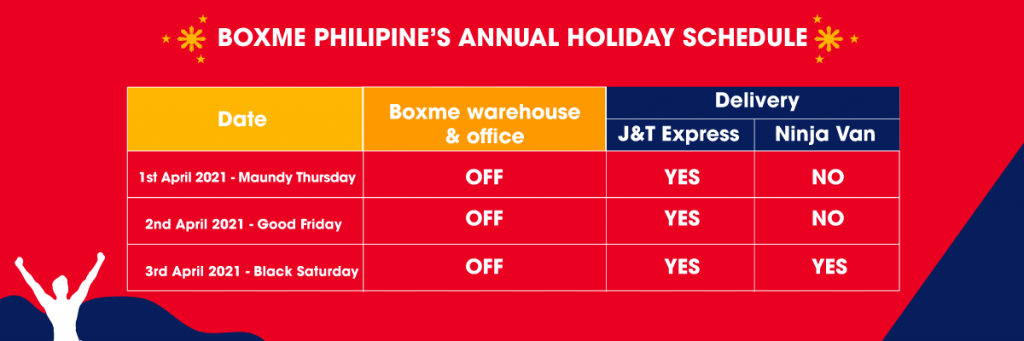

Boxme Philippines’ annual holiday schedule

To ensure the transparency of Boxme’s service and to serve customers in the most thoughtful way, Boxme would like to announce our annual holiday schedule of Boxme Philipines as follows:

Boxme Philipines’ Office and Warehouse will be off working: From 01/04/2021 to 03/04/2021

Delivery Couriers: Ninja Van will stop working from 01/04/2021 – 02/04/2021 and will be back to normal on 03/04/2021

J&T Express will operate normally on holiday.

Boxme warehouse will return to work on Monday – 05/04/2021

If you have any question, please chat with our customer support team or email support@boxme.asia

Thank you for understanding and sorry for any inconvenience it may cause.

The increase in logistics demand tripled the growth of e-commerce

In the report on the future journey of Vietnam’s logistics industry, JLL Vietnam said that e-commerce (e-commerce) is a great driving force for logistics real estate development. In which, the demand for logistics (especially cold storage) will increase dramatically, spurring growth for the whole industry in the future, especially when the economy recovers after Covid-19.

>> Read more: Vietnam enters in the top 10 of emerging logistics market 2021

>> Read more: Which one is the best warehouse management strategy: FIFO, FEFO or LIFO?

>> Read more:Lunar New Year Tet 2021 in the phase of Covid-19

In the context of the global pandemic, trade businesses all over the world and in Vietnam are experiencing a strong shift in sales structure for the domestic consumption market, from traditional mega-mall to omni-channel.

>> Read more:Lunar New Year Tet 2021 in the phase of Covid-19

Accordingly, the shape of the logistics industry can also shift with this change. Lets together with Boxme discover the new trend and to what extent does the logistics demand increase in Vietnam.

The logistics demand tripled the e-commerce growth

Vietnam JLL has given some evaluations about the development journey of logistics demand in Vietnam in upcoming years.

>>>Read more: Vietnam enters in the top 10 of emerging logistics market 2021

In a press conference with the topic “The future path of Vietnam’s logistics industry” which took place on the morning of December 15, JLL Vietnam assessed that e-commerce is a great driving force for logistics real estate demand.

Generally, e-commerce companies use more logistic space than traditional retailers. This is largely due to the wider product ranges of e-commerce businesses, large inventory levels, greater overseas shipping space requirements, and two-way logistics needs (return and exchange).

>> Read moreUnderstand the importance of reverse logistics in your supply chain

>> Read more: Key factors of E-commerce logistics in Vietnam

According to Ms. Trang Bui, JLL Senior Director of Vietnam market, in the past 2 years, FDI inflows into logistics real estate in Vietnam have increased sharply. Big investors had made huge capital of about $ 3 billion for phase 1 and some are also calling for phase 2 investment.

>> Read more: Warehousing vs Fulfillment: Which logistics solution is right for your business?

>>> Read more: Vietnam enters in the top 10 of emerging logistics market 2021

“The demand of investors in industrial real estate when entering the Vietnam market at this time is also increasing. In the past, they often needed to find a land fund to develop with a scale of 5,000-10,000 m2. The course has increased to 10,000 – 50,000 m2, “commented Ms. Trang Bui.

>>> Read more: Which one is the best warehouse management strategy: FIFO, FEFO or LIFO?

In addition, this unit assessed that cold storage will be an emerging segment in the future logistics sector when more and more consumers are ordering goods online during the pandemic.

Logistics demand – towards the future

Many experts believe that in order to achieve future expansion goals, Vietnam’s logistics industry will still have to overcome many challenges. First of all, in order for Vietnam to move to the next stage in logistics development, and gaining more competitive advantages and even before other countries, it is necessary to continue to maintain a reasonable level of investment. Infrastructure, emphasis should be placed on the development of both highways and utility networks, including renewable energy.

>> Read more: Vietnam enters in the top 10 of emerging logistics market 2021

>> Read more: Key factors of E-commerce logistics in Vietnam

According to experts from JLL Vietnam, the Covid-19 epidemic is speeding up the automation process in the logistics sector and will become a major trend in the coming time. Warehouse tenants are having the intention to upgrade from outdated, small, and medium-sized privately owned properties to a more modern property in a better location.

More readings?

>>Read more:Understand the importance of reverse logistics in your supply chain

> Read more: Vietnam enters in the top 10 of emerging logistics market 2021

>>>Read more:Key factors of E-commerce logistics in Vietnam

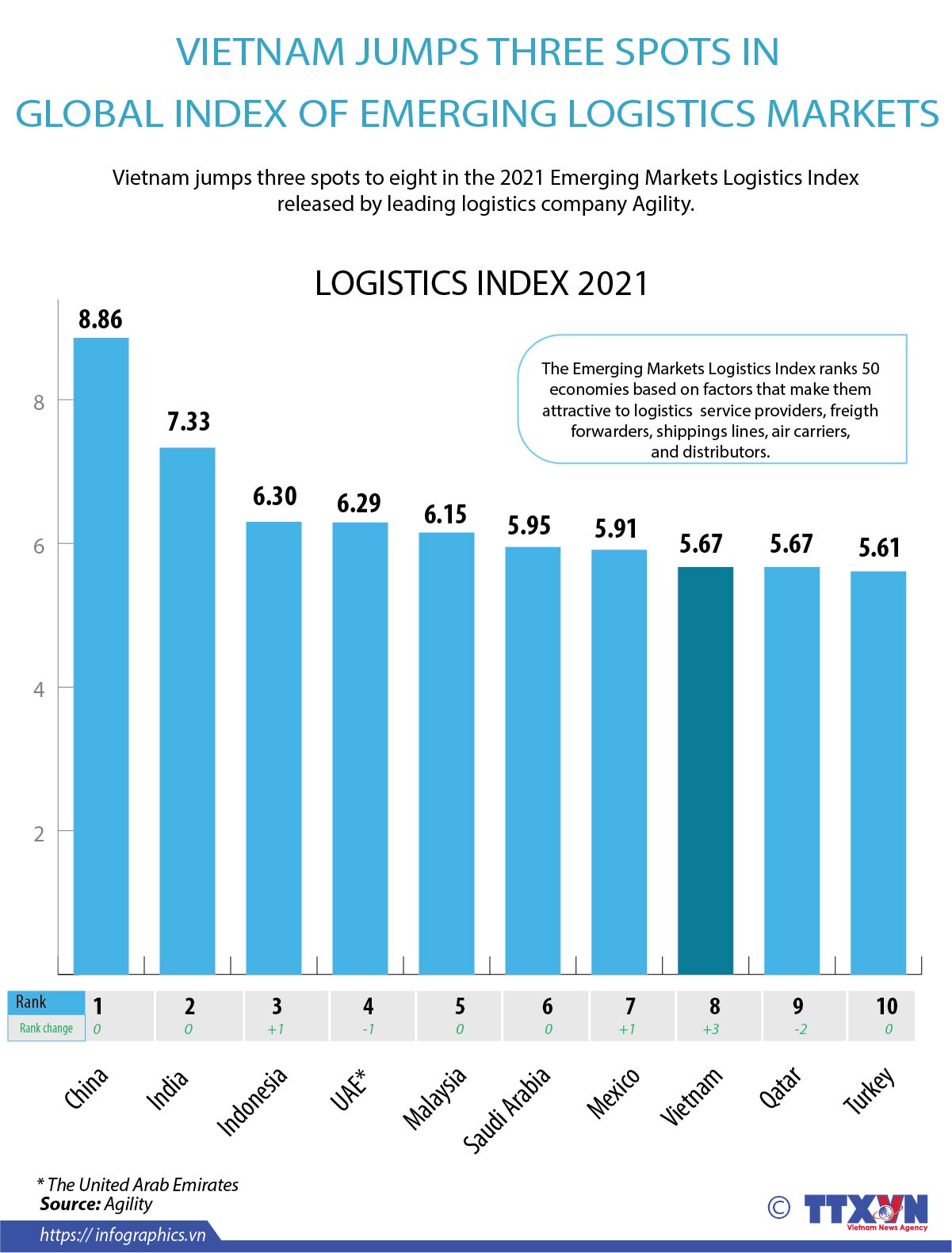

Vietnam enters in the top 10 of emerging logistics market 2021

Vietnam’s logistics market has witnessed drastic growth thanks to the country’s booming GDP, rising manufacturing, and e-commerce sectors. Additionally, the rapid adoption of e-commerce by the country’s young demographic has increased the demand for expansion in logistic services.

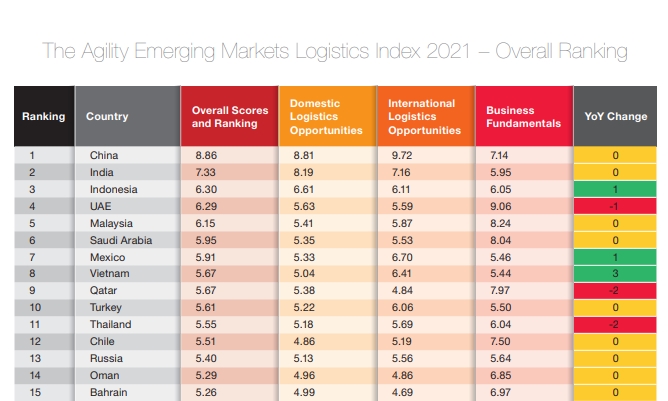

According to the Market Logistics Index report, Vietnam has a striking jump into the 8th position in this year’s global index of emerging logistics markets. The country had an overall score of 5.67 out of 10 in 2021.

Accordingly, China remained the world’s leading emerging logistics market followed by India, while Indonesia ranked in third position. Qatar and Turkey ranked behind Vietnam in 9th and 10th position. Among ASEAN countries, Indonesia ranked third, Malaysia ranked fifth, Vietnam ranked 8th, Thailand ranked 11th, Philippines ranked 21st and Cambodia 41st.

>> Read more: Vietnam rises as a manufacture destination amid US-China trade war

>> Read more: Key factors of E-commerce logistics in Vietnam

Based on the data provided by Vietnam Logistics Business Association’s survey, there are around 30,000 logistics companies in the country, 4,000 of them foreign-owned.

The industry has been growing at 12-14 percent annually and is now worth $40-42 billion.

The eight place of Vietnam in the global logistics markets indicate the successful suppression of the country from the global pandemic Covid 19. Vietnam effectively positioned the market to attract businesses, investors to leave highly-contaminated covid countries such as China and possess an enviable investment pipeline across a number of sectors for example: fashion, electronics, and so on.

>>> Read more: The landscape of eCommerce in Vietnam in 2020

This trend is predicted to further grow to the year 2022.

According to the Vietnam Logistics Business Association‘s latest survey, there are around 30,000 logistics companies in the country, 4,000 of them foreign-owned.

The industry has been growing at 12-14 percent annually and is now worth $40-42 billion.

>> Read more: Vietnam media landscape 2020; 5 changes to notice

>> Read more:The map of Vietnam Ecommerce (statistics from iPrice)

On the other hand, the investment and the arrival of foreign businesses in Vietnam can create some challenges. For instance, Weak transport infrastructure and high logistics cost remain to be market restraints.

Increasing GDP, dominance of the young generation together with the constant adoption of new technologies has posed a greatest chance for Vietnam e-commerce, particularly the logistics market to further grow in upcoming years.

>> Read more: Vietnam eCommerce is heading for the period 2021 – 2025

>> Read more: Vietnam media landscape 2020; 5 changes to notice

It is predicted for the logistics market to have new trends in the year 2021. Let’s find out with Boxme what are these new trends in the next article.

Philippines’s top e-commerce fulfillment service 2021

Looking to take your eCommerce brand cross-border? Shipping to the Philippines can be a great way to do just that! Here’s a closer look at some market insights and other key information you need to know about the Philippine’s top e-commerce fulfillment service.

Noticeable eCommerce Growth in The Philippines

According to the statista report of Philippines e-commerce, revenue in the eCommerce market is projected to reach US$4,421m in 2021. In recent years, e-commerce in Philippines has had growing years and expected to skyrocket to $21 billion by 2025.

>> Read more: Philippine’s; top 4 E-commerce platforms in 2020

>> Read more: Philippines: An E-commerce landscape like no others

In the same report, there are approximately 76 million Internet users with the penetration at the highest peak of 71% in 2020. Among those Internet users, there is an obvious increasing trend of online shoppers together with rapid growth in mobile e-commerce.

>>>Read more: Philippines: An E-commerce landscape like no others

It is without a doubt the Philippines – your next stop for doing cross-border e-commerce business.

Shipping to The Philippines

The first and foremost question for any business owner to embark business in the Philippines is to make a decision of how to specifically handle the shipping to the Philippines. There are various options available in the market.

>> Read more: [Southeast Asia] Export Potential in the Philippines (PART I)

>>Read more: [Southeast Asia] Export Potential in the Philippines (PART II)

There are many local and international couriers and fulfilment centres available that cater to almost every kind of business.In this article, Boxme collects and delivers the Philippine’s top e-commerce fulfilment service for retailers.

>> Read more: [Southeast Asia] Export Potential in the Philippines (PART III)

>> Read more: Boxme Philippines partners up with shipping courier J&T Express

Local e-commerce fulfillment service in Philippines

Local couriers are especially useful for the last leg of the order fulfilment and delivery. A few that serve the Philippines include:

- Ninja Van Philippines: Ninja Van is proud to be the only last-mile delivery provider with 100% service coverage in Southeast Asia and the Philippines

Ninja vans offer various services to customers such as Cash-on-delivery service, flexible pick-up points, tons of delivery budget options.

Ninja vans offer various services to customers such as Cash-on-delivery service, flexible pick-up points, tons of delivery budget options.

- my Entre go is a digital logistics platform that provides business solutions for small, medium, and large enterprises around the Philippines.

Operating in only the Philippines nation, myEntro go is proud to provide the most affordable fulfillment service, free pickup within Merto Manila and Cavite, and also next day pickup and delivery with the company’s affiliate businesses.

Operating in only the Philippines nation, myEntro go is proud to provide the most affordable fulfillment service, free pickup within Merto Manila and Cavite, and also next day pickup and delivery with the company’s affiliate businesses.

- Otto is an advanced cross-border Phillipine’s top e-commerce fulfilment network in the Philippines, enabling world-wide merchants to sell online without establishing a local presence.

Otto’s aim to solve business logistics and fulfillment problems by easing your importing process into the Philippines, picking up parcels, storing, dropshipping, and delivering to customers.

Otto’s aim to solve business logistics and fulfillment problems by easing your importing process into the Philippines, picking up parcels, storing, dropshipping, and delivering to customers.

- Fastbreak: provide a comprehensive service to our customers. Here at fastbreak, we provide the delivery service from small parcels, important documents too big, large-scale items. With 10 years of experience in the fulfillment and logistics services, Fastbreak ensures your goods arrive on time every time. If you are based in the UK and need goods delivered fast we can help there too.

International tope-commerce fulfillment service in Philippines

Many international couriers provide simple and affordable shipping solutions for shipping to the Philippines from the U.S. and other countries.

- United States Postal Service: Among various options for international postal delivery to the Philippines, USPS stands out from others as the cheapest yet convenient in most cases.

For regular mail, you can send a letter postcard or greeting card with a first-class stamp. For packages, you will need to visit your local post office or https://www.usps.com/ for international requirements and rates.

For regular mail, you can send a letter postcard or greeting card with a first-class stamp. For packages, you will need to visit your local post office or https://www.usps.com/ for international requirements and rates.

- DHL: DHL is known as the leading logistics company with warehouses in more than 220 countries. DHL guaranteed to deliver the top-tier delivery service and freight shipping to customers in every corner.

A comprehensive suite of services drawing on our global scale and local insight to deliver value across your entire supply chain.

A comprehensive suite of services drawing on our global scale and local insight to deliver value across your entire supply chain.

- FedEx: FedEx Corp is one of the world’s largest express transportation companies.

FedEx has been operating in the Philippines for more than 36 years, the company has marked its milestone in the Philippines with the latest investment in the country- the new getaway that worth more than 30 million USD. The core competitive advantage of FedEx within the country is the location. Located in the new smart and green metropolis area has enabled FedEx to be more strategic and booming with potential. The expansion of the company’s operations in the north of the Philippines has definitely complemented the transport infrastructure to provide enhanced mobility and connectivity across the country. FedEx refurbished its Philippines headquarters in Makati and equipped it with the latest technologies that aim to enhance collaboration, promote learning, offer flexible working environments, and improve employee mobility.

FedEx has been operating in the Philippines for more than 36 years, the company has marked its milestone in the Philippines with the latest investment in the country- the new getaway that worth more than 30 million USD. The core competitive advantage of FedEx within the country is the location. Located in the new smart and green metropolis area has enabled FedEx to be more strategic and booming with potential. The expansion of the company’s operations in the north of the Philippines has definitely complemented the transport infrastructure to provide enhanced mobility and connectivity across the country. FedEx refurbished its Philippines headquarters in Makati and equipped it with the latest technologies that aim to enhance collaboration, promote learning, offer flexible working environments, and improve employee mobility.

- Global Post is one of the Philippines’ top e-commerce fulfilment services that assist businesses in delivering and shipping parcels in the quickest and most affordable way thanks to the connection with global postal carriers and commercial carriers.

These partnerships allow Global Post to offer time and money-saving features not found with traditional international services.

These partnerships allow Global Post to offer time and money-saving features not found with traditional international services.

Boxme – Southeast Asia’s Premier E-commerce Fulfillment Provider

These are overall suggestions for business to consider when doing cross-border, choosing logistics service in Philippines. However, there are many problem along with carrying cross-border in Philippines such as: import/export regulation, national laws on import goods. In Boxme, our core value is the localisation, we are proud to provide customers with local insights that enable retailers to overcome barriers in cross-border commerce, culture and language; allow us to assist customers to penetrate the Southeast Asia region in the shortest time possible.

Boxme has extended our network in Philippines, create connection with Philippine’s top e-commerce fulfilment service. Our customers can be care-free when doing business in Philippines.

More readings?

>>Read more: Philippines: An E-commerce landscape like no others

>>Read more: [Southeast Asia] Export Potential in the Philippines (PART I)

>>Read more:[Southeast Asia] Export Potential in the Philippines (PART II)

>> Read more: [Southeast Asia] Export Potential in the Philippines (PART III)

ShopeePay Chinese New Year Promo, Up to 90% Discount

ShopeePay Chinese New Year Promo, Up to 90% Discount

ShopeePay’s digital and electronic money payment platform enlivens The Chinese New Year 2572 Kongzili through various discounts that last until February 21, 2021.

Head of Campaigns & Growth, Marketing ShopeePay Cindy Candiawan explained that in the midst of one of the big celebrations in Indonesia, there is still a pandemic nuance that requires Chinese new year celebrations to be eliminated and should be celebrated with family from home.

Therefore, ShopeePay as the leading digital payment service in Indonesia presents ShopeePay Super Online Deals campaign with cashback promo up to 90 percent for various types of purchase transactions.

This cashback promo is valid for online merchant categories such as games, telecommunications, delivery services, food and beverages, and Sociolla beauty products e-commerce.

Saw the huge customer enthusiasm on shopeepay super online deals campaign earlier at the end of last year. In February which is festive and special in the midst of the implementation of PSBB, ShopeePay again provides attractive cashback promos so that Chinese New Year celebrations can remain warm and meaningful, even from home.

This campaign also reinforces ShopeePay’s commitment in providing digital payment services to more useful use cases for the community.

For telecommunications, ShopeePay cashback promo up to 90 percent can be used for MyTelkomsel, Axisnet, By.U and Smartfren data packages, in order to be able to talk or video call as much as possible with the whole family.

In addition, ShopeePay understands that Chinese New Year is usually synonymous with sending food, it’s strange if the excitement of various types of food that is usually served on the dining table when Chinese New Year is gone.

No need to worry, order food from many places or send food to more friends or relatives more efficiently and quickly with ShopeePay cashback promo up to 90 percent at Paxel, Help, or Anteraja delivery service. Through the food shared, the warmth of Chinese New Year special moments can definitely be felt more for everyone.

This promo also applies to people who often spend the afternoon relaxing or hold quality time, while drinking a glass of favorite coffee, where ShopeePay cashback up to 90 percent also applies to Kopi Kenangan and Fore Coffee.

By utilizing the promo presented from the ShopeePay Super Online Deal campaign, guaranteed Chinese New Year celebrations from home again and in the middle of the pandemic will be as warm, meaningful and exciting as before.

About Boxme: Boxme is the premier E-commerce fulfillment network in Southeast Asia, enabling world-wide merchants to sell online into this region without needing to establish a local presence. We deliver our services by aggregating and operating a one-stop value chain of logistic professions including: International shipping, customs clearance, warehousing, connection to local marketplaces, pick and pack, last-mile delivery, local payment collection and oversea remittance.